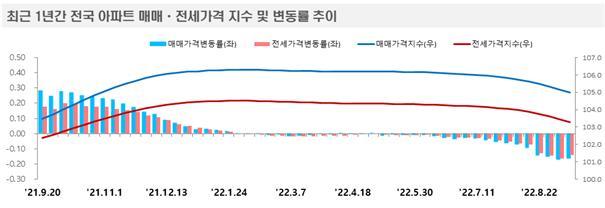

Graph: Nationwide cost of high-rise condos (blue) from September 2021 to August 2022. Credit: Korea Real Estate Board.

According to the Korea Real Estate Board (KREB) 한국부동산원, a public corporation in charge of providing official real estate value assessments, the value of nationwide real estate dropped by 0.29% in August compared to the previous month – the biggest monthly drop since KREB began keeping records in 1969. The price of high-rise condos 아파트, the staple of South Korean housing, suffered the greatest decline with 0.51%, while the price of low-rise condos 연립주택 fell by 0.06% and the price of single-family houses 단독주택 rose by 0.19%.

The prices are dropping as the interest rates are rising, making it difficult for homeowners with variable interest mortgages to continue paying the interest. In addition to being a significant economic force, the price of real estate - especially in Seoul - is a deeply political issue, capable of swinging a close presidential election. (See previous coverage, “The Real Estate Election, Again.”)

The declining price of real estate makes it difficult for the Yoon Suk-yeol 윤석열 administration to aggressively raise the benchmark interest rate, because doing so would put additional pressure on the housing market. Failure to raise the interest rate, however, makes it difficult to combat inflation as well as the soaring KRW-USD exchange rate. (See previous coverage, “The Triple Quandary.”)

On September 15, the intraday KRW-USD exchange rate rose up to KRW 1397.9 per USD 1 before the Korean government released its dollar reserves to have the exchange rate settle at around KRW 1393 per USD 1. The KRW-USD exchange rate is at its highest level since March 31, 2009, when the intraday rate rose to KRW 1422.0 per USD 1 in the aftermath of the global financial crisis and the failure of Lehman Brothers.