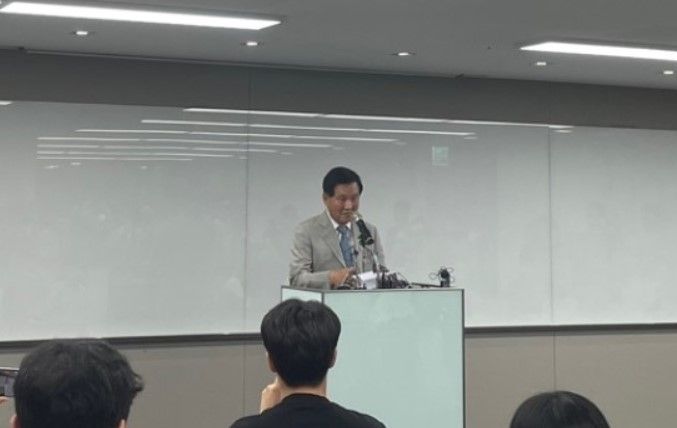

Photo: Kim Ik-rae announces his resignation as the CEO of Daou Kiwoom Holdings following a stock manipulation scandal. Credit: Daou Kiwoom.

On April 24, the Seoul Southern District Prosecutor’s Office 서울남부지방검찰청 banned ten individuals suspected of being involved in a stock manipulation scheme from leaving the country. The same day, officers from the Seoul Gangnam Police Station 서울강남경찰서 raided the individuals’ office, seizing more than 200 cell phones. The investigation caused a sudden and massive drop in the share prices of eight companies, mainly energy companies such as Daesung Holdings 대성홀딩스 and Seoul City Gas Company 서울도시가스.

South Korean media, somewhat unfairly, dubbed this incident the SG Securities Panic SG증권 패닉, as the sell orders that brought down the share prices of the eight companies mostly came from SG Securities SG 증권, the outpost of Societe Generale in South Korea. The share prices of these companies showed steady improvements from mid-2022, despite the poor performance of South Korea’s stock market overall. (See previous coverage, “The Triple Quandary: Stock Market, Inflation, and Exchange Rate.”)

But within four days of the announcement of the investigation, more than KRW 8t (USD 6b) in market capitalization evaporated from these eight companies. Preliminary reports suggest that the companies’ share prices rose because of a pump-and-dump scheme that incorporated a Ponzi scheme-like drive to attract more investors to buy into the stocks. Among those implicated is veteran K-pop star-turned-producer Im Chang-jeong 임창정, who used his celebrity to attract new investors for the companies.

Also involved is Kim Ik-rae 김익래, founder and chief executive officer of Daou Kiwoom Group 다우키움그룹, who attracted suspicion when he sold KRW 60.5b (USD 45.9m) worth of shares in Daou Data Corporation 다우데이타, one of the eight companies, shortly before the share price began crashing. On May 4, Kim resigned from his position as CEO and chairman of Daou Kiwoom Group, despite maintaining that his sales were legal.