Photo: Kim Ju-hyeon. Credit: Seoul Shinmun.

As the April 2024 General Election draws near, the Yoon Suk-yeol 윤석열 administration and the ruling People Power Party 국민의힘 have been making hare-brained appeals to voters’ greed, such as their proposal to expand the borders of Seoul to raise real estate values in neighboring cities. (See previous coverage, “PPP Doubles Down on Real Estate.”)

A sudden ban on short sales was another attempt. On November 5, the Financial Services Commission 금융위원회 abruptly announced that it would suspend short-selling in the stock market until early 2024, due to what it claimed was increased market volatility caused by the conflict between Israel and Hamas - a transparently pretextual excuse. The real reason for the freeze on short selling is plain to all: South Korea’s stock market has been suffering, and the average investor incorrectly blames short sellers for his losses. Unsurprisingly, the ban did not improve conditions in the South Korean stock market, which only saw a one-day rally before regressing to its previous level.

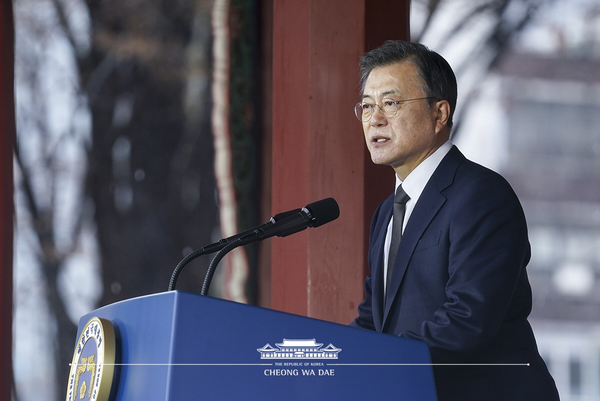

Yoon is pressing ahead nevertheless. In remarks on November 14, Yoon said the government would ban short-selling “indefinitely,” until “fundamental improvements are in place to prevent further damages caused by illegal short sales.” On November 15, news media reported rumors thaton November 15 that Kim Ju-hyeon 김주현, chief of the Financial Services Commission 금융위원회, will be sacked. Kim had been a vocal opponent of the short selling ban, saying back in October: “Given the importance of international investors, I don’t see how installing this complex system [of banning short sales], which no other country does, protects individual investors.”

Conservative newspapers, heretofore faithful allies to the Yoon administration, have been aghast at the short sale ban. Chosun Ilbo 조선일보 ran an unusually critical editorial on November 20, arguing that the abrupt ban would drive international investors away from South Korea. The conservative paper’s sister publication Invest Chosun 인베스트 조선 took an even stronger stance, calling the ban “an unbelievable initiative for a government that is supposedly pro-market and pro-freedom.”

Noting that the Yoon administration’s interference in the stock market could extend to attacking protections for market makers, Invest Chosun article decried: “We might as well be going back to 1992, before the South Korean capital market became open to the world.”